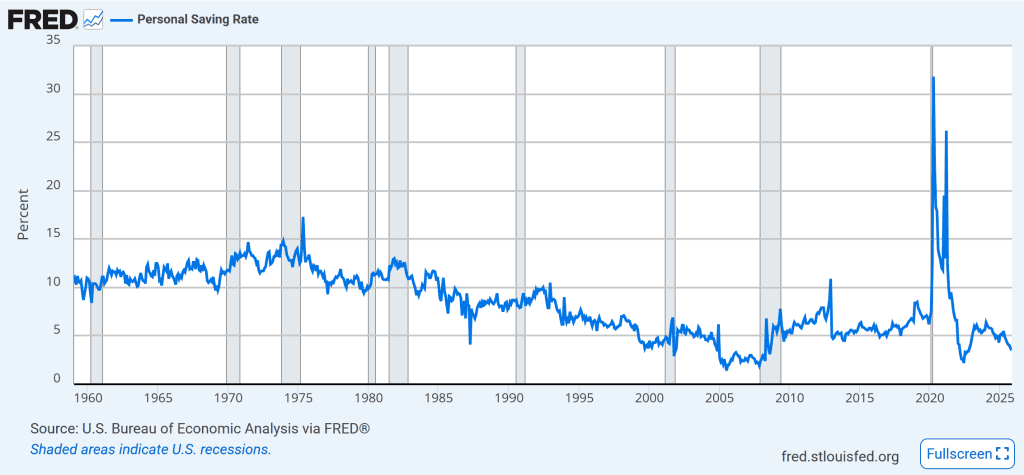

Americans used to believe in saving. Saving between 10-15% every year was common. That isn’t the case anymore. Currently Americans only save around 2-5% per year. And some of this ‘savings’ isn’t even really savings, rather it’s investing or, more accurately, speculating.

Saving has gotten a bad rap in the last 30 years or so, and there are some good reasons for this negativity, which I will go into in a bit. But suffice to say, for now, these criticisms are overhyped, and often can be over-come. Savings, rather than being something we should limit, is arguably the most important thing we can do for our families and our own financial future.

First, I want to clarify what I mean by savings, and what I mean by investing and speculation.

Saving, as a verb, is the process of putting money into a place that is safe and liquid, and ideally continues to grow, at least with inflation. Savings as a noun, is money stored in a place that is safe and liquid.

Investing, as a verb, is the process of putting ones saved money, or capital, to work via purchasing/creating a productive asset that will create cash flow and a likely return of principal. An investment, as a noun, is something that returns your capital and creates an income stream from interest/dividends in addition to this return of capital; it has high chances of returning capital AND producing additional wealth in the form of income.

Speculating is the process of buying and selling with the purpose of expecting the price of the assets to increase or decrease over time. It is more like gambling and has a lower likelihood of returning capital. Typically, more volatile, higher highs and lower lows.

Why do people criticize ‘savings’?

Over the years there have been many criticisms of sa vings, some of which are completely reasonable.

vings, some of which are completely reasonable.

For example, the main argument as to why you shouldn’t save more than just a few months of expenses, is because of price inflation. If you keep your savings in a FDIC checking or savings account for safety and liquidity, you’re probably not earning enough to keep up with price inflation, in fact, you’re probably earning close to 0%, meaning your savings is simply losing value every day.

This is a perfectly reasonable argument, and it’s 100% true. That being said, the key then is to make sure you are saving in a vehicle that will at least keep up with price inflation, or ideally surpass it. Your savings needs to maintain its purchasing power, and preferably increase in purchasing power.

A slightly divergent point, the fact that this is the case has not always been reality. Prior to the US government officially ending the gold standard in 1971, you could save in a simple checking or savings account and be close to ensured (outside of war times) that your savings would retain its purchasing power simply by being stored somewhere safe. It wasn’t until the US severed this gold backing that price inflation became the consistent state of things. Now we must take added risk and make more sophisticated choices if we are going to at least keep up with this hidden government tax we call price inflation (or really, to more accurately describe the situation: the destruction of purchasing power of our money).

So, to protect one’s self from this threat of price inflation, the best place to store your savings over the medium and long term is in a properly designed whole life insurance policy with a top-rated mutual company.

Not only will this allow your capital to surpass the rate of price inflation, you will also benefit from a death benefit, better tax treatment, and even other protections like asset protection (depending on the state), long term care and/or critical care protection and more (these last three are variable and depend on various factors, so talk to a trained agent for this—check out the Nelson Nash Institute for trained agents in your area).

This was also a strategy for most Americans for more than a hundred years, and though it isn’t as popular now, it should be.

Earn more elsewhere

The next major criticism you’ll hear is “why let your money sit earning a few percent when you can just put it in the stock market and earn 10% per year?!” Now, I have written a blog post on the reality of stock market returns, which you can read here, but to summarize, the myth of 12%, or 10%, or even 8% real returns in the stock market is nothing more than a myth for most people. Once you factor in fees, taxes, portfolio design and psychological issues, the reality is that most people earn around 2.5%-5.5% over the long term. The idea of average rate of return is nothing more than a misleading sales pitch.

But not only this, even if it were true that you could count on this supposed average rate of return, putting your money into the stock market, broadly speaking, is nothing more than speculation. It is a hope that the price of the general market, or a specific stock, will increase so that you can sell at a gain (you could argue that buying stocks for dividends is less speculation and closer to true investing though).

What comes with this sort of speculation is volatility, and potentially long periods of negative growth. Now imagine if instead of saving your money, you put it in the stock market to get the promised 10% return per year, but the market drops 30%. Now when an emergency occurs you need to access your capital but your only option is to withdraw and it is now worth just 60% of what it was. Well now you lock in those losses and even compound the losses by taking the remaining principal out to use it for said emergency (assuming you didn’t trap your capital in a qualified retirement account where you would also have to pay penalties and taxes to access it).

Now, there may be better real investment opportunities you could choose to put your money in rather than in savings, for example real estate, land flipping, private loans etc. All of which are potentially great investment opportunities, but the problem is almost all these investment or speculative options mean a loss of liquidity, safety and/or control. It isn’t to say you shouldn’t ever invest or speculate, but the important point is to ensure you have correctly valued your savings and what it can do for you and built it to a point where you can begin to invest and/or speculate.

So, let’s dive in and go over all the benefits of saving.

- Emergencies – Without savings: you borrow. With savings: you stay in control. Most people would agree that some level of basic savings is needed to protect from what we might call ‘emergencies’. You’ve probably all heard of the idea of having an emergency fund, this would be a liquid account you can pull from in case of one-off unplanned, but expected, expenses occur. For example, car repairs, medical bills, new water heater, loss of job etc. Depending on who you are listening to, the general advice is to have anywhere from three months to two years of expenses in a liquid account (I would argue 1-2 years is preferable though).

This is the first of two main reasons people save and retain some liquid savings, but an important point to realize here is that the importance of this isn’t just to make sure you can cover those bills with cash, but in case of an emergency, if you didn’t have the liquid cash, you would be forced to compound your losses. You would almost certainly have to run to high interest debt to pay your bills, likely a credit card. Now you would have to pay 15-30% interest rates and do more than just replenish your savings, you would now have to work even harder to get out of the high interest debt as well.

Don’t let this happen to you, focus on creating an emergency fund. Ensure you create a situation for yourself where you don’t need to be reactive, but rather, can stay in control.

- Planned Purchases – The next most common reason people save is for a planned purchase, like a downpayment on a home, a wedding or a vacation. This is obvious as to why. If you have an expensive goal that you need to eventually pay for, most people understand they need to cut back on consumption and start socking money away. But they also don’t want these dollars to lose value, or disappear, as the day approaches, thus you wouldn’t want to speculate with these dollars, or put them into an investment that may not be liquid. So, you store the money in a liquid account to use when the day comes. Like the first instance, you are much better off if you save money to spend on these things, rather than use debt (there are some exceptions to this).

- Opportunities (the most overlooked reason) – This is a rarely discussed reason to save, but in my opinion, it is one of the most important reasons and is probably one of the most likely ways to make someone wealthy. Having liquid capital, that doesn’t have a specific purpose—like being your emergency fund or being used for a planned downpayment on a home—allows you something that most people will never have access to: opportunities. If you have capital available sudden opportunities present themselves to you, more than you will ever realize existed, and you will have the ability to capitalize on some of these opportunities that you otherwise would never have been able to capitalize on, or even knew existed.

Imagine an opportunity like someone having a fire-sale of their family assets due to a large tax bill, or a market crash, or a business being sold well under market price due to some extreme circumstances. The person who can capitalize on these opportunities is often going to be someone with liquid capital who can quickly close the deal. These sorts of opportunities don’t exist if you lack capital. So, save, even if you have no specific purpose, make your purpose be for opportunities.

- Peace of Mind (low stress/anxiety) – Building a comfortable cash position also gives you other non-financial benefits, mainly it gives you peace of mind and lowers stress and anxiety around your finances. By creating this liquid savings, you become secure in the fact that no matter what happens, you will have the ability to weather the storm. This fact alone will help you sleep better at night, decrease your stress, and improve your health. So don’t overlook this reason.

- Independence & Freedom – Capital allows you to negotiate from a better place of strength – aren’t forced into bad jobs or bad deals – can walk away from unfair or unhealthy situations – savings buys time, choices and mental freedom. Imagine two people, Tom and Tiffany, just graduating college and entering the workforce, both are now searching for a career that they are excited about and pays well. Both are leaving with a hefty student loan bill, which they will need to start paying payments on right away. Tom has no savings to speak of, but Tiffany, through a combination of her own and her parents’ savings, in a properly designed whole life policy they took out on her when she was 10, has $50,000. Who of these two is in a better place to find the job that best suits their skills and desired income level? Tom is forced to take the first job offer he gets, even though it is likely not the best fit. Tiffany, on the other hand, can wait and have more patience until she finds something close to a perfect fit. The bills are coming immediately for both, but Tom needs the income and can’t afford to be picky, Tiffany on the other hand benefits from the liquid capital saved over the years and this allows her to be more careful with her decisions. She will generally have a much less stressed and more fulfilling life.

Or imagine you get a new boss who is miserable to work for. The person who has the savings can afford to leave the position, the person who doesn’t is stuck and miserable. Having enough in savings gives you FU money and it gives you more control over your life.

- Building a wealthier foundation – This is similar to #2 and #3 but it’s an important point to reinforce. You need to save before you can invest. If you want to get into real estate, start a business, buy a business, invest in the market, enter into private loans etc., you must first save to do these things. So, saving/deferring consumption, let’s you eventually invest and build a foundation of wealth. Capital is the fuel that powers every wealth making strategy.

- Teaching your children (modeling discipline) – For those of you who have children this is another secondary benefit of saving. By practicing the habit of paying yourself first, and talking about it, your children learn from you and will learn the discipline of saving. You can use this to help teach them about tradeoffs, opportunity costs, delayed gratification, goal setting and more. By building this culture of saving you help them create more freedom for their future selves and set them up for a more prosperous life.

- Capital creates flexibility – Having the liquid capital also lets you build the life and future you want. Without it your decisions are all based on needs and fear and driven by money. With capital you can make the choices you actually prefer, without having to make them based solely on money. You can relocate to the state or town you’ve always wanted to live in. Take the sabbatical or mini retirement you’ve dreamed of. Spend the time doing philanthropy or pursuing that creative project or start-up business you’ve always wanted to try. Your life becomes yours again.

- Creates Independence – Lastly, having savings lets you be independent. Without it you are dependent. Dependent on government, institutions, your job, or others, all of who then get to control you, since you rely on them for your income. Having savings lets you be independent and in control.

Conclusion

If you have no savings, or too little savings, start focusing on building the habit of paying yourself first. You can do so through either earning more income—maybe with a side hustle or working more hours/being more efficient—or by cutting unnecessary expenditures—maybe you cut back on eating out, get rid of the unnecessary subscriptions etc., or do both. Then take the new income, or amount of spending you cut and start saving that, either in a high yield savings or, preferably, in a properly designed whole life policy with a mutual company. If you have credit card debt, take 50% of this new income, or reduced expenditures, and put it towards paying down that high interest debt.

Next, pick a goal of what you need for an emergency fund. This will vary by individual and their particular circumstances. For example, if you are a business owner, or someone who works on commission, or if you have a family, you should shoot for 1-2 years’ worth of liquid savings. If you are a W-2 wage earner in a stable career (not sure how many of those exist anymore) and are single, then maybe 6-12 months is more appropriate. So, if you decide you want 12 months of emergency savings, and your monthly expenses are $10,000, then you need to accumulate $120,000 in your savings vehicle.

Next, determine what the ‘F-U’ amount is for you to be able to tell a boss/job “F-U. I’m out of here”. For some, that may be the same as the emergency fund, for others it may mean doubling your emergency fund.

This is your ideal amount of liquid savings. Once you hit this, continue your saving habit and build out your opportunity fund, use this additional capital to buy assets and create more income for yourself and continue to save and invest this until you are financially free.

This isn’t ‘easy’, but it is a simple process.

To summarize: Pay yourself first. Build your savings. Then start to invest your excess savings and continue until your investment income equals your monthly expenses.

Let us know what you think in the comments!