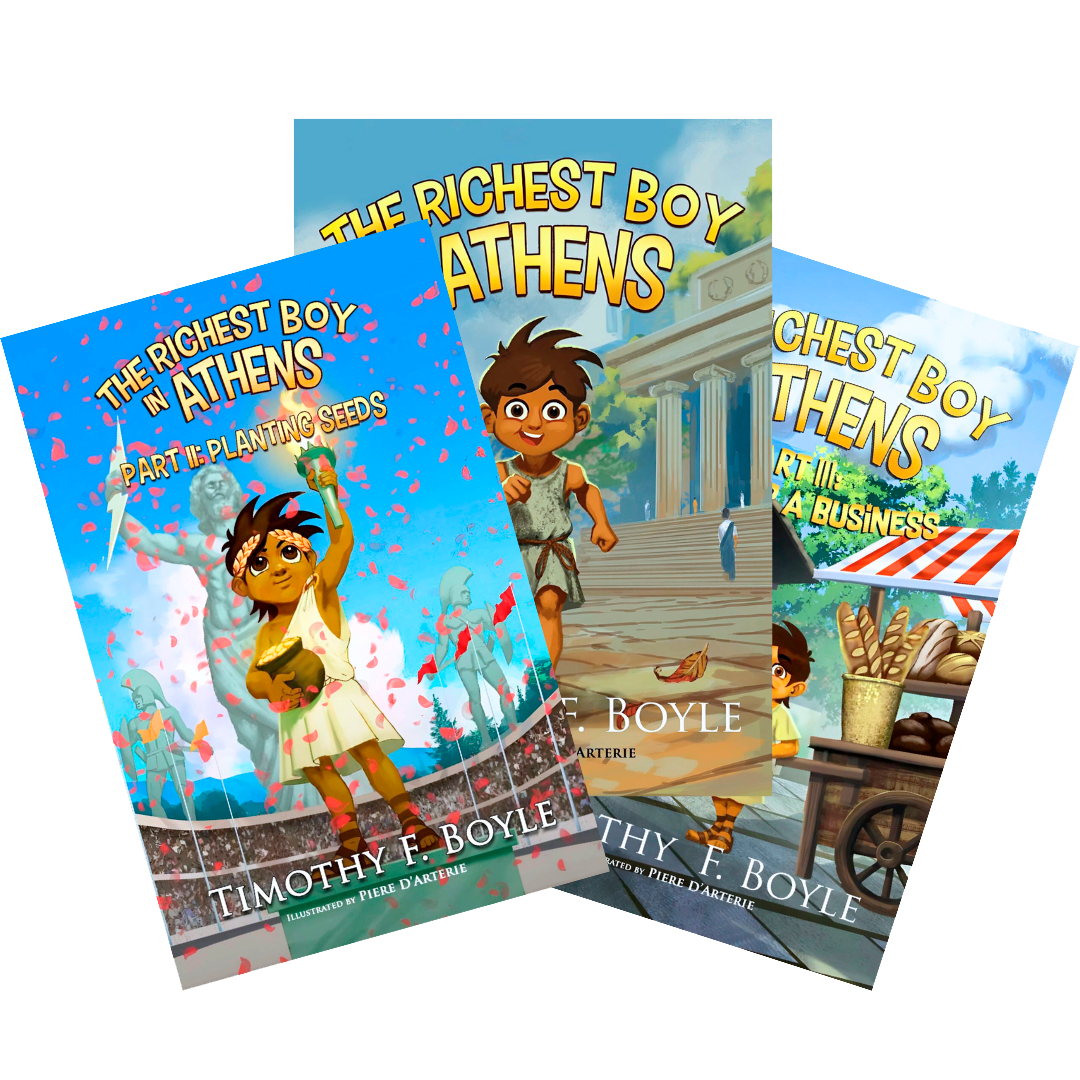

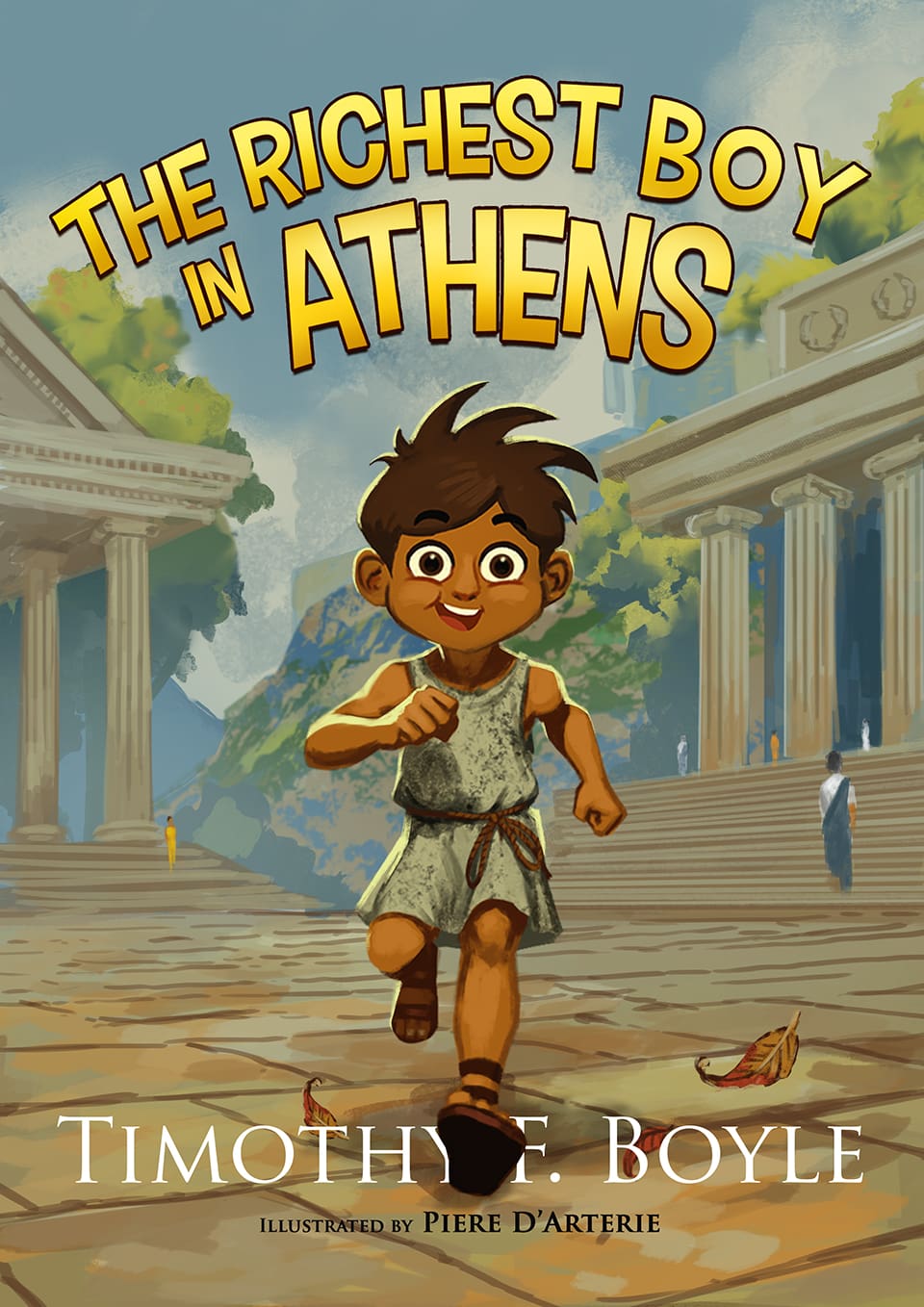

Give Your Child Financial Skills Most Adults Wish They Learned Earlier

Ages 6–12

Engaging illustrations & storytelling

Teaches saving, earning, investing & smart decision-making

$59.97 ̶8̶̶̶9̶̶̶.̶̶̶9̶̶̶7̶̶̶

Includes Parts I, II & III of The Richest Boy in Athens series.

You Want Your Child to Be Smart with

Money… But How?

As a mom, you already know:

Schools don't teach this

Your child learns math, but has no idea how money actually works.

Add to Cart

You don't want them to struggle like you did

Maybe you learned about debt, saving, or budgeting the hard way.

Add to Cart

Finance feels boring and complicated

How do you make a 7-year-old care about money without glazing their eyes over?

Add to Cart

Every day without these skills is a missed opportunity

Financial habits form early—and last forever.

Add to Cart

The Truth?

Children who learn money principles early develop confidence and decision-making skills that transform their entire lives.

Get only for $59.97 ̶8̶̶̶9̶̶̶.̶̶̶9̶̶̶7̶̶̶.

Parents Are Already Seeing the Difference

Having read The Richest Man in Babylon myself, I was excited to see a re-telling aimed at kids. I’ve read it aloud twice to my younger kids, and my older son read it and started asking questions about financial ideas! Definitely sparking creative thinking and we look forward to the next book!

⭐⭐⭐⭐⭐

My son (6) and daughter (4) loved this book. And the most impressive part is that they didn’t even realize they were learning about financial literacy. It wasn’t for another day or two when they told me they wanted to save their allowance for a few weeks in order to buy a bigger toy instead of buying candy. Seeing them learn through reading made my heart melt.

⭐⭐⭐⭐⭐

My kids love the beautiful illustrations along with the engaging and relatable story of young Kap trying to make his way in life. What a great way to teach kids the principles of entrepreneurship and serving others to create wealth. Highly recommended!

Finally: A Story That Teaches Money Without Feeling Like a Lesson

Meet Kap, a curious boy in Ancient Athens who dreams of owning a beautiful toy soldier. But he has no money and no idea how to earn it.

Through his adventure, Kap discovers:

How to earn money by creating value

Why saving today leads to bigger rewards tomorrow

How to set goals and actually achieve them

The power of patience and smart choices

Your child won’t realize they’re learning life-changing financial principles. They’ll just think it’s a great story about a kid who achieves his dream.

Level of Students

Adventure story, not a textbook

Ancient Greece setting sparks curiosity

Real situations kids relate to

Character-driven with failures AND successes (real learning)

Give Your Child the Gift of Financial Confidence

Ships in 2 Days

Secure Checkout

Free Shipping Over $25

The Skills That Will Benefit Them for Life

Through Kap’s journey, your child naturally absorbs:

Work Ethic & Responsibility

Understanding that money comes from creating value, not thin air

Pay Yourself First

The saving habit that builds wealth over time

Goal Setting & Achievement

How to want something, plan for it, and make it happen

Delayed Gratification

Why waiting and planning beats impulsive decisions every time

Critical Thinking About Money

They’ll start asking “How can I earn this?” instead of “Can you buy me this?”

Created by a Former Financial Advisor Who Knows What Kids Need

Tim Boyle spent years as a financial advisor helping adults fix money mistakes they wished they’d never made. Influenced by his father and grandfather, he became passionate about one mission: teaching children financial wisdom BEFORE they learn it the hard way.

Tim spent years distilling complex financial concepts into simple, engaging stories. His love of history inspired the Ancient Athens setting—making the book both educational and captivating.

The result?

A book that gives children the head start most of us never had.

The story adapts timeless lessons from The Richest Man in Babylon—one of the most trusted personal finance books ever written—into a format perfect for young minds.

Common Questions from Parents

Q: What age is best?

A: Ages 6-12. Younger kids love to read aloud; older kids read independently and apply lessons immediately.

Q: Will my child actually read it?

A: It’s an adventure story first—fast-paced with a relatable hero. Even reluctant readers get hooked.

Q: Do they need to know about Ancient Greece?

A: Not at all! Everything is explained simply, and many kids become interested in history because of it.

Q: Is there more than one book?

A: Yes! Part II teaches investing. Part III (entrepreneurship) releases December 2025.

This Isn't Just a Book. It's an Investment in Your Child's Future.

“This Isn’t Just a Book. It’s an Investment in Your Child’s Future.”

Think about how much financial stress costs over a lifetime. Now imagine your child avoiding all of that—because they learned earning, saving, and smart decision-making young enough for it to become second nature.

For less than $60, you’re giving your child:

Confidence in handling money

Skills that compound over a lifetime

Lessons most adults wish they'd learned earlier

A story they'll remember forever

Every day without these lessons is a missed opportunity. Financial habits form early.

Money-back guarantee

Contact