It’s a common myth that most wealthy individuals were born into their riches, handed everything on a silver platter. It’s an easy belief to hold—comforting, even. After all, if “the rich” inherited their money and you didn’t, then your financial situation is simply the result of bad luck, not choices. Right?

But the truth tells a very different story.

In the U.S., 88% of millionaires are self-made. Only 21% inherited any wealth at all, and among those, just 3% inherited $1 million or more. Even at the billionaire level, 68% are self-made, while only 32% inherited their fortune.

In other words, the vast majority of the “wealthy” didn’t inherit their wealth—they built it.

Why This Matters: You Have More Control Than You Think

The good news? This means that you, too, have a real opportunity to achieve wealth. Your background doesn’t determine your financial future. Despite the flaws in our system, the path to wealth remains open to those willing to pursue it wisely and persistently.

The bad news? You have more control than you realize. That means blaming others, your circumstances, or the economy can become an excuse that holds you back. If you want to change your financial future, you must take ownership of it.

Generational Wealth: Why Most Families Lose It

Generational Wealth: Why Most Families Lose It

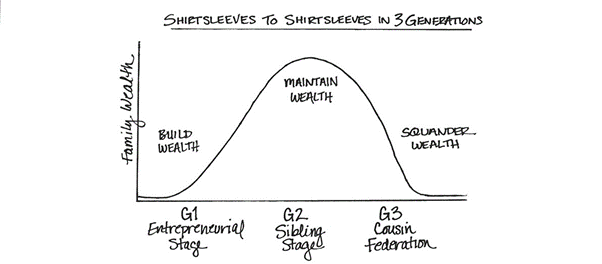

Here’s the flip side: It’s actually tragic how often wealth is lost in just a generation or two.

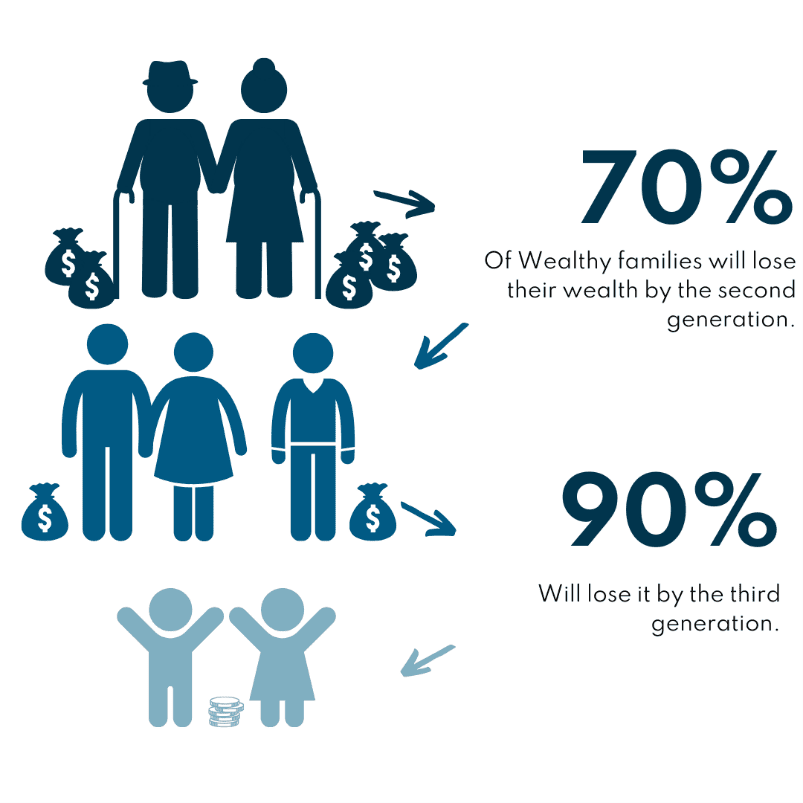

- 70% of wealthy families lose their wealth by the second generation.

- 90% lose it by the third generation.

That means only 10% of grandchildren of wealth-builders maintain their family’s wealth.

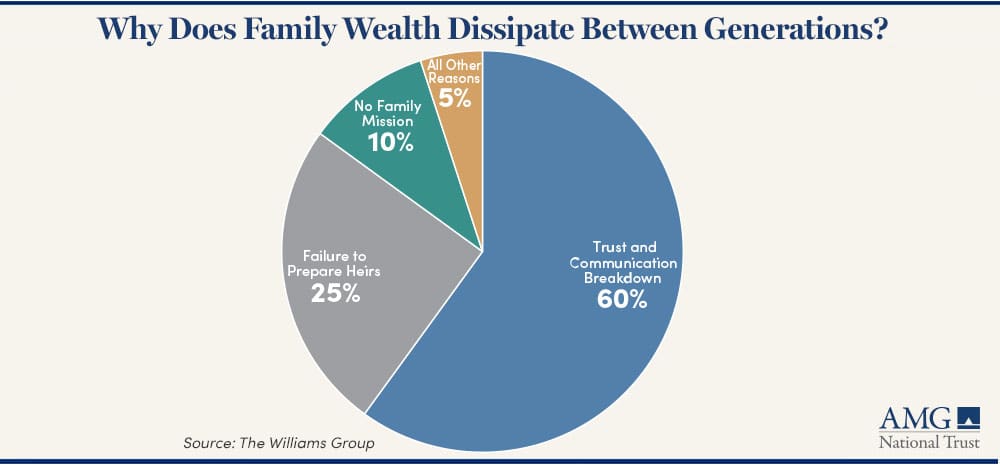

Why does this happen? Most often, it’s not due to bad investments or poor financial advice.

A study of wealthy families found:

- 60% said wealth was lost due to a breakdown of trust and communication within the family.

- 25% said it was due to unprepared heirs.

- Only 3% blamed poor investment performance or bad advice.

This tells us that financial education, values, and communication matter more than rates of return.

How to Preserve Wealth—and Build a Lasting Legacy

How to Preserve Wealth—and Build a Lasting Legacy

If you want to prevent your children or grandchildren from losing the wealth you worked hard to build, the solution isn’t secrecy or avoidance. It’s engagement.

Talk openly about money. Involve your heirs in the process of building, growing, and preserving wealth. Teach them not just how to manage wealth, but why, and to what end.

But what about creating “trust fund babies”? Many fear their kids will become entitled, lazy, or directionless if given wealth. That’s a valid concern—but it’s avoidable.

The key is how you raise them. Character traits—like drive, humility, purpose, and responsibility—are shaped by your example, your values, and your conversations.

Practical Tips to Prevent Entitlement

Practical Tips to Prevent Entitlement

One strategy to maintain control and purpose in your wealth transfer is through a trust with specific guidelines. Instead of handing over wealth for consumption, structure it to fund:

- Education (e.g., trade school or college)

- First-time home purchases

- Real estate investments

- Business start-up costs

This empowers your heirs to use wealth for growth, not dependency.

For books on how and what to do, check out these here and here.

Legacy Beyond Money

Perhaps most important: Legacy is more than financial wealth. Without a foundation of values and wisdom, financial wealth is easily squandered.

Focus on passing down:

- A strong moral compass

- Long-term thinking and goal setting

- A non-materialistic mindset

- A spiritual foundation

- Practical knowledge in finance, economics, law, and history

These are the building blocks of a resilient, successful family for generations to come.

Final Thoughts

As parents and wealth-builders, our greatest responsibility isn’t just accumulating money—it’s preparing our families to steward it wisely. That may seem daunting, but it’s also the most meaningful legacy you can leave.

For deeper insight into building generational wealth and preventing entitlement, I recommend the following books:

Punished by Rewards – For parenting in a way to help promote self motivation and drive.

Perpetual Wealth – For a detailed explanation of Why and How.

What Would the Rockefellers Do? – For a great big picture strategy of how to pass on wealth and values.

Complete Family Wealth – To understand how to pass on family values, not just wealth.

Don’t just pass on wealth. Pass on wisdom, purpose, and a vision that lasts.

If you are looking for help to build out your financial legacy, or are looking to start a trust, or have any questions around this concept, you can reach out to me here and I will either help you myself, or point you to someone who can.